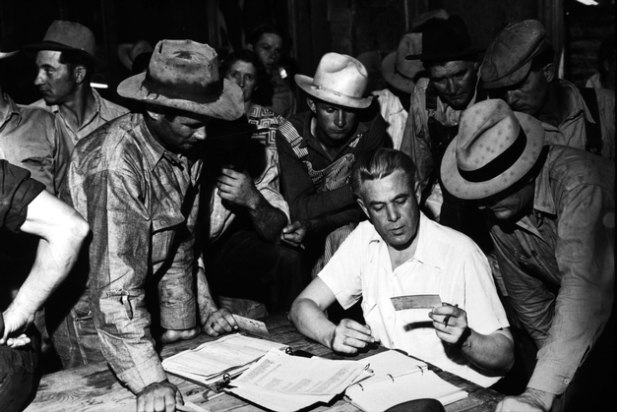

At the height of the Great Depression, FDR took extreme measures to halt massive bank closures with the Emergency Banking Act of 1933.

From the opening years of the Great Depression, Herbert Hoover had hoped for individual and private solutions for the economic difficulties faced by Americans. Many – but by no means all – who have studied his choices have labeled them “laissez-faire” (literally “leave to do” or more commonly “hands off”). Regardless of public christening, there is little doubt that Franklin Roosevelt was elected for exactly the opposite aim – direct, decisive and drastic intervention. He delivered.

Again, history would remember Roosevelt’s New Deal measures in many and varied ways. Considered in equal measure heroic and disastrous, there is little room for argument that many of his measures made vast and immediate differences.

Thousands of Bank Closures

In the first four years following the collapse of Wall Street on Black Tuesday, October 29, 1929, banks had been closing by the thousands. In 1931 alone, 2300 banks shut their doors. In 1933, that number almost doubled to more than 4000. Panic was universal, and there was no end in sight.

As soon as FDR took office in 1933, he took sweeping action to try to turn around the plummeting economy. One of his first actions in March of that year was to halt massive bank closures by declaring a banking holiday. From Monday, March 6 to Thursday, March 9, 1933, all banks in the US were closed for business. Then, on March 9, in what some would see as retroactive CYA, Roosevelt quickly wrote and pushed to Congress an amendment to the “Trading with the Enemy Act” (TEA) passed during World War I, legalizing the closures he had just enacted. This was the Emergency Banking Act of 1933.

Emergency Banking Act of 1933

Title 1 Section 1 of the Emergency Banking Act confirmed the President’s actions/rules/etc taken since March 4, 1933 under the TEA, also called “Act of October 16, 1917”. In other words, it legalized things the President had already done but without renewing proper legal consent. It extended the President’s powers under the TEA to include persons within US or any place under its jurisdiction, rather than just foreign countries.

Sections 2 and 3 prohibited hoarding, melting, etc, of gold by private citizens and gave the Treasury the right to confiscate all privately held gold, paying for it with cash. That cash was not backed by gold, as it had been before.

Section 4 made doing business with banks during a declared emergency illegal, except by permission from the President of the US.

Title 2, called the “Bank Conservation Act”, provided for a Comptroller of the Currency and essentially put the national banking system in receivership. Of course, the official title for the “receiver” was “conservator”. The controller had the ability to take control over the banks and set the rules for running them, limiting withdrawals and debt payments under the direction of the President in an emergency. Title 2 also gave the rules for reorganizing banks. This effectively gave the President absolute control of national finances during a declared emergency.

Title 3 governed the handling of shares of bank stock, common and preferred. It outlined the notification and treatment of shareholders, protecting the interests of the holders of preferred stocks first and foremost over those of common stocks. Banks could then absolve themselves of their debts as long as the Comptroller of Currency and the majority of their stockholders agreed.

Title 4 allowed banks to convert their debts into cash, and any checks or drafts into cash but at only 90% of their value.

Finally, Title 5 set aside $2,000,000 for expenditures incurred by the Treasury in executing this act.

Lasting Effects

It could reasonably be argued that simply to use the “banking holiday” to halt the race to bankruptcy would have been sufficient, that the confiscation of gold and outlawing private ownership of it was unnecessary and unconstitutional. The gold standard which had backed US currency since the founding of this nation was gone, never to return. Fortunately for Americans, the right to privately own gold was restored on January 1, 1975.

One other banking act passed in 1933 that lives on today more appreciated by private citizens. The Glass-Steagall Act of 1933 (not to be confused with the first Glass-Steagall Act, passed in February, 1932), provided for the Federal Deposit Insurance Corporation. At its onset, the maximum amount a single depositor could have insured in a single bank was $2500. Today that amount has grown to $250,000, protecting checking and savings deposits and certificates of deposit, but not mutual funds, annuities, stocks, bonds, treasury securities and other investment products. In time, even those standards may evolve.

Sources:

Documents of American History, Emergency Banking Act of 1933, Web

United States Treasury, Trading with the Enemy Act, Web

Internet Archive, Glass-Steagal Act (1933), Web

Federal Deposit Insurance Corporation, Insured or Not Insured? Web

Copyright Elizabeth Linehan